Charlie returned home from his business trip late Wednesday night. The kids were elated to see him ... me even moreso. I was asleep on my feet less than 10 minutes after he walked in the front door and I was in bed snoring loudly by 8:45 PM. The next thing I know ... it's 8:00 AM Thursday morning.

Charlie returned home from his business trip late Wednesday night. The kids were elated to see him ... me even moreso. I was asleep on my feet less than 10 minutes after he walked in the front door and I was in bed snoring loudly by 8:45 PM. The next thing I know ... it's 8:00 AM Thursday morning. I truly love the man that gets up with three toddlers, changes their diapers, suctions their stuffy noses, feeds them breakfast, gets them dressed for the day ... and then, keeps them quietly entertained so that I can continue sleeping.

All hail Charlie, King of the Toddlers!

Since the time that my husband has returned, I have continued to pester him that we need a larger house we have resumed our talks on moving. We've spoken to several realtors and we've spoken to a few people that are interested in purchasing our house, directly. Today, we spent the better part of the day looking at homes. Lots and lots of homes. BECAUSE ... we've convinced ourselves that if we ARE going to move - we may as well move in to a house that is going to offer us more than an additional 600 square feet.

** Insert sticker shock and subsequent hyperventilation that comes with houses (and property taxes) for homes >2,500 square feet in desirable areas, in San Diego, California. **

If you've never walked through a gorgeously decorated model home with three toddlers who are doggedly determined to touch every single breakable item - and jump on the meticulously appointed bed - I strongly encourage you to ignore the urge if it ever strikes. However, trying to ignore three toddlers who enjoy walking up the OUTSIDE of an 18-foot staircase is not recommended. Even if it does keep them quiet.

Now, I'm no Suze Orman ... but I am starting to think that I am pretty conservative when it comes to money. Ever since I've had a job ... other than working part-time for my dad at his pharmacy when I was 12 ... I've been careful to save at least 10% of my income. In recent years, that has escalated to more like 20%, safely tucked away in a 401K. I don't even think about the fact that I'm saving, because I have it automatically deducted from my pay. Yet, when I receive quarterly statements - I am happily reminded that I've got a nice little account that has been growing through the years and it gives me a warm, fuzzy feeling.

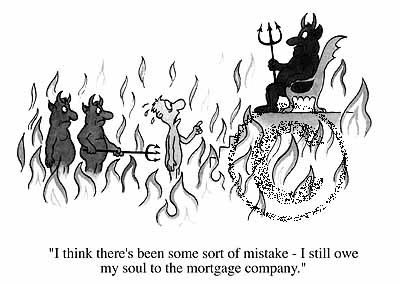

We are extremely lucky that we bought our home before every thing in California went completely through the roof. Although prices have stabilized somewhat, they are no where near the levels they were when we first bought in to the real estate market 10 years ago. But here we are ... with our growing family ... and an overwhelming

Yet, given the state of the housing market, we are asking ourselves ... is it worth it to sell our house and buy something larger, possibly having to reduce the amount of money we are contributing every month to our savings account ... or ... does it make more financial sense to stay where we are - pay our house down, suck up the fact that we have ZERO room (and baby Nemo really will be sleeping in one of the drawers from our dresser), and purchase a house in a few years - when the cost of living may potentially be even higher than it is right now?

Is it possible that purchasing a new home, will be as fantastic of an investment as purchasing our current house turned out to be? (Assuming we still decide to remain in California - which at the moment - seems like the most logical place to be.)

Today, we found a few homes that we really liked.

I mean, we really, really, really liked them.

It was difficult to get past the gorgeous double ovens, butler's pantry, multiple car garage, breathtaking views, and our three children happily, and yet safely, occupied in an expansive laundry room. These were certainly the kind of homes that we could imagine ourselves living in for the next 20 years ... or more. The school district is phenomenol, there are award-winning recreation centers and year-round pools, and parks galore - all within walking distance.

Now the question is - what kind of financial sacrifice do we want to make to live there?

Do we want to reduce our savings contributions, even if it is for the short term?

Do we want to live off of Ramen noodles and potatoes, with protein in the form of hotdogs?

When we bought our house 10-years ago, it was a stretch for us. Can we assume that we'll have to make that stretch again, but eventually it will balance out, like it did - here?

I've read the advice "drive inexpensive cars but live in the nicest house you can afford." In this day and age, and in a California real estate market, is it realistic to have a debt to income ratio of 36% or less ... when you have three (almost four) children - all of whom wear diapers?

If so, Jay's 96-square foot house on wheels is starting to sound pretty good, again.

Love your blog!!!

ReplyDeleteThe other day as I was driving and thinking of your housing predicament a thought popped into my head.

Have you ever looked into Houston?

It's cheap to live there ... we bought a brand spankin new never been lived in 3,000 sq ft brick home for $159k. The day we signed, December 31st, we went out to eat to celebrate. We sat on the veranda in the gorgeous 75 degree weather. We were working for an Oil Field company at the time so there's that. Tons to do and somewhat close to the beach depending on what side of the city you live in. Mexican ... oh yum ... the best!!!

Of course, it's easy for me to say ... we are not afraid to move as evidenced by the many places we have lived ... OR, IL, OR, OK, -Houston-, WA, IA and currently in NY waiting for the next job to come in line ... hopefully back in Wa.

Praying that you find the perfect solution for your family!!!

God Bless!!!

Dare I mention that my dh was in GA with family this week and he found a 5bdrm. house on a lake with land/multiple car garage/private boat dock for $750K. I just about died.

ReplyDeleteI completely understand your housing dilemma. I have the urge to move also, just not as big of an urge as you.

Dear Jenn

ReplyDeleteWe fell in love with our current home the moment we stepped inside. It was way more than what we were prepared to spend. We were in love and had to have it.

For the first year at least twice a week (if not more) we would turn to each other and say "wow, we live here!"

In the second year the property boom hit. We now have a great investment as well as a home we love and could not afford to buy in today's market.

If you find a home you love and feel happy in, it is worth the money.

Home should be your sanctuary, and with the gorgeous trio and Nemo you will probably be spending a lot of time at home.

You and Charlie WILL make the right choice

i have to say that is one thing i don't miss about living in CA- it is the biggest thing that would keep us from moving back- A home is our #1 financial priority- it is where we make our memories it is the place i want us to love to be- good luck- sounds exciting though- i love a new house!

ReplyDeleteBoy do I know what you mean about sticker shock. Long Island is out of control just like California is in the housing respect. Hopefully you and Charlie will find something that you can both fall in love with, and afford!!!

ReplyDeleteWell, I'm one of those "bubble believers" so . . .

ReplyDeleteIf you do jump in now (otherwise known as, "catching a falling knife") be sure you will be okay with staying in the house for at least 10 years, or that you will have enough equity to be able to withstand the possibility of the house losing 30 percent of its value during the time you own it. Not to say it won't come back (after some time) but it could be a decade or longer before we see such heights again.

Even in San Diego.

Can you tell I'm popular at dinner parties?

OTOH, if you can possibly wait even a year, you are going to be looking a WHOLE DIFFERENT market for housing. The lending will be harder, tho. We bought our first house in a buyers market/housing bust and while we got a deal, the financing was a long, drawn-out process - and we had plenty to put down. After this credit bubble really and truly pops, it will be a lot harder to get "easy money" for housing or anything else from whatever lenders are left standing.

The good part of that is, if you can afford to buy at this point, even if rates are kind of high, you can refinance later on when they drop again (which they will). To me it's better to buy a house at a realistic price point, and get into "how much a month" thinking - it's easier to refi a realistic price point (which today's housing values ARE NOT, due to the loose credit) than it is to deal with the fact that you bought when values were way too high.

Okay, don't want to go on too long. I know it's tough. I'm not sure what to say. Just be sure you can easily afford your mortgage in the new house (plus HOAs, taxes, insurance of course), don't use any kind of creative financing, and be mentally prepared for a price drop in the house's value in the next couple of years - and hopefully plan to stay there for a good long time.

Wow, GOOD FOR YOU for being so good and diligent with your money. Putting aside 20%... WOW (again)! You could have your OWN money talk show.

ReplyDeleteIt sounds to me like you certainly deserve the gorgeous homes you've been looking at... and then your kids can touch everything and you won't have to worry about it being a model home!!

Good luck with everything... I know how stressful it can be to move, and I wasn't pregnant, and a mother to triplets, when I was moving!

Jen- your blog actually gives me anxiety attacks. Would you just MAKE A DESICION already???? You are freaking me out!!!!!

ReplyDeleteBlackorchid just really freaked me out. Move to Montana or better yet meet me in the middle of the sun and we can each have the biggest houses and biggest families on the block.